Table of Content

Down payment assistance programs and/or grants were researched by the team at FHA.com. Please note that all programs listed on this website may involve a second mortgage with payments that are forgiven, deferred, or subsidized in some manner until resale of the mortgaged property. One of the programs that MSHDA offers is the MI First Home Down Payment Assistance . This down payment assistance is a zero-interest, non-amortizing loan with no monthly payments. MSHDA’s Homeownership division provides a variety of programs and products for both homebuyers and homeowners. We can help if you’re trying to purchase a home, improve your current property or are facing foreclosure.

Kind of like when you are purchasing a car and opt for the leather seats instead of fabric. In the case of using the MSHDA option, the state is covering part of the down payment that is required and also some of the closing costs with an zero interest loan. That’s right MSHDA is not “free” money, it’s a loan from the state at a zero percent interest rate that is paid back when the house is sold or mortgage refinanced. The Michigan State Housing Development Authority offers Down Payment Assistance to help homebuyers purchase a home. It is a second mortgage that must be used in conjunction with MSHDA's MI First Home or MSHDA's MI Next Home first mortgage.

Investment Property Loans

The down payment assistance program helps cover many of the upfront costs of homeownership. The biggest benefit to a MSHDA loan is that it provides opportunity for homeownership where it might not otherwise be possible, due to the large barrier of saving up enough money for a down payment. Meaning, home buyers can purchase a home with very little money down. The MSHDA program only requires you to provide at least one percent of the total loan amount. The primary benefit to a MSHDA loan is the down payment assistance program , which gives people an opportunity to purchase a home without all of the typical upfront cash.

Without this program, it’s unlikely she would have ever been able to purchase her own home. The rest can be covered with the down payment assistance program. The FHA Loan is the type of mortgage most commonly used by first-time homebuyers and there's plenty of good reasons why. FHA.com's compilation is not a complete list, but it can serve as a starting point in your search for the down payment assistance program or grant for your situation.

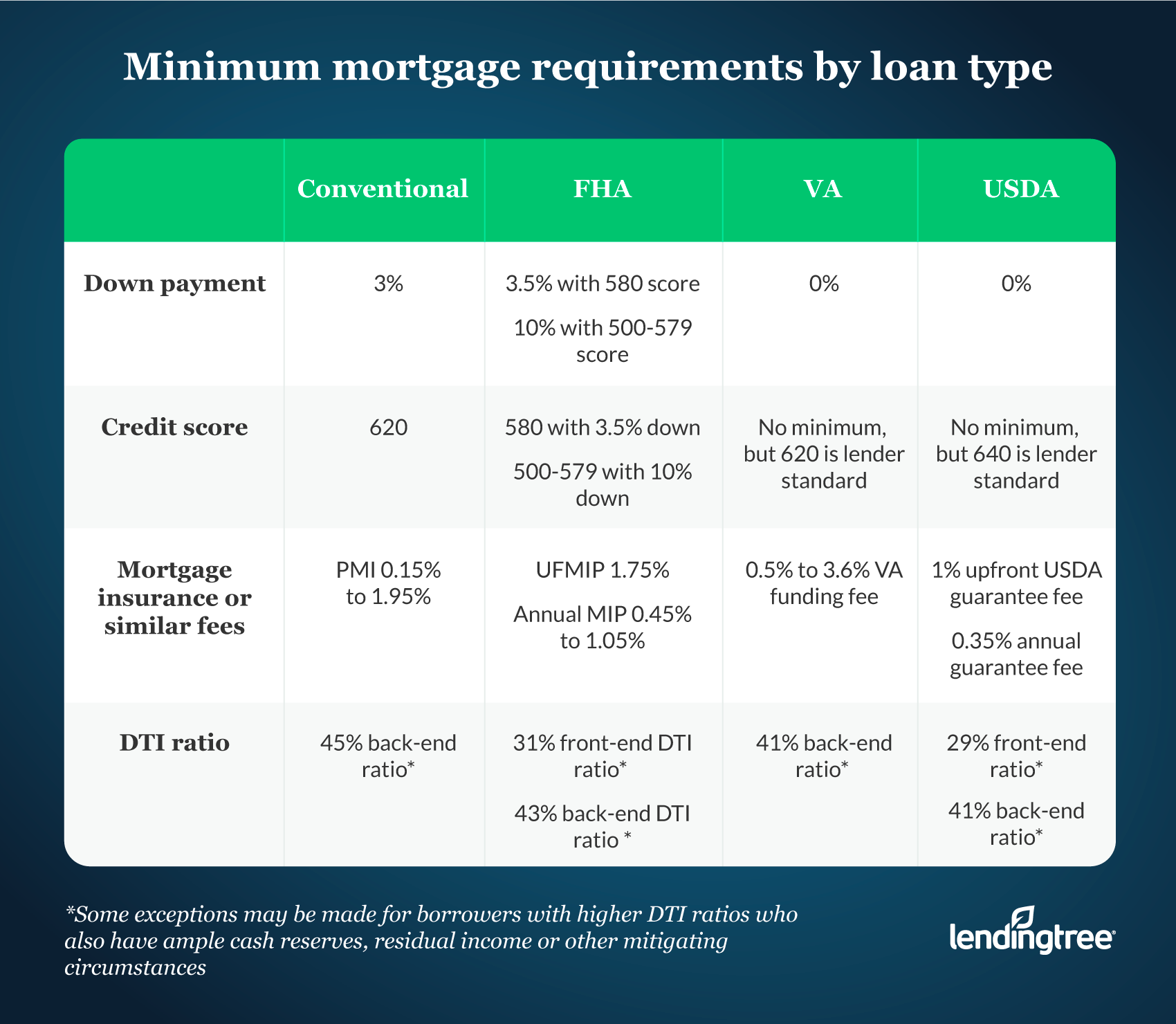

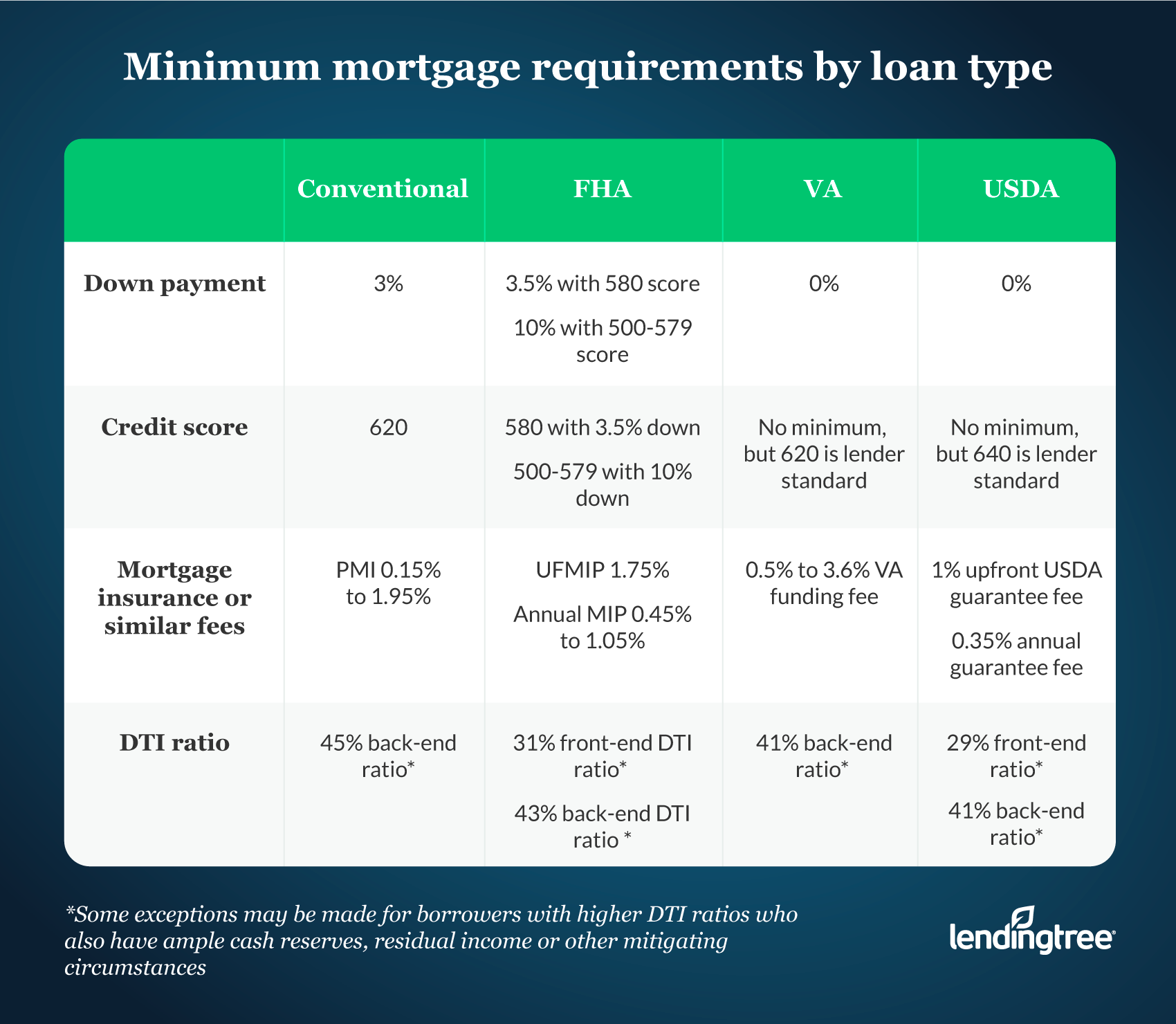

Loan Options - Conventional, MSHDA, FHA, VA, USDA & More

MSHDA offers a series of loans to home buyers, both first time and repeat buyers, as well as current homeowners. There are three loan products that are offered through MSHDA. Household income limitsapply and can vary depending on family size and property location. The MI Home Loan program is a mortgage product that is available to first-time homebuyers state-wide and repeat homebuyers in targeted areas. All homebuyers work directly with a participating lender.

Or, you could find yourself in a negative equity position if home values drop. So, for example, if you’re purchasing a home for $150,000, then you need to be able to bring $1,500 to the closing table as down payment. So, someone who owned a home five years ago will qualify for the program.

MSHDA Loan: Guide to MI Home Loan and DPA

Down payment and other factors shown are for informational purposes only and are not intended as an advertisement or commitment to lend. Contact us for an exact quote and for more information on fees and terms. Not intended as legal, accounting, or investment advice. Contact your tax preparer for more information on income tax deductions. If the borrower qualifies, they can put down as much money as they want and get the MSHDA subsidized interest rate.

In another example, let’s say the home value is $110,000. In this case, you could pay off the $100,000 mortgage balance and $4,500 towards the down payment assistance loan. Since people often refer to a MSHDA loan as a first time home buyer grant, it’s often mistaken as free money with no pay back requirement. However, there can be some real cons to the MSHDA loan program.

This mortgage loan program is designed primarily for first-time homebuyers and allows the borrower to put a lower down payment and have less than perfect credit. Seller can contribute up to 6% of the purchase price to the buyer towards closing costs. Inlanta Mortgage offers a variety of home renovation loan programs that allow homebuyers to finance the cost of renovations in with their home purchase or refinance. However, the following list represents the most popular Michigan home loan programs we regularly provide to our clients.

For example, if you bought a home and received $7,500 in down payment assistance, you would need to pay the full amount of $7,500, along with your mortgage balance, at the time of selling your home. In addition to the mortgage loan, you will need to repay the MSHDA loan back. It will be the amount of down payment assistance that you accepted. While the down payment assistance loan doesn’t require monthly payments, it does have to be paid back.

With Covid, you can find these classes in multiple formats — online and in-person. Our partnership with one of Michigan’s top MSHDA lenders allows us to help home buyers get connected and qualified for MSHDA loans. For example, if you sell your home or refinance your mortgage, the down payment assistance will need to be paid back. To be able to buy a home with the MSHDA program and provide a safe, stable environment for her daughter brought her to tears.

Inlanta serves many investor clients who need unique and detailed loan programs to finance and renovate income properties. Contact Us to discuss all of your investment financing options. The MI Home Loan Flex requires only borrowers to meet the requirements.

Given the bond program through MSHDA, there is a good chance that most mortgage products won’t be able to compare, in terms of rates, with a MSHDA loan. You’re likely to have a lower interest rate unless interest rates dropped dramatically since the time you closed on your MSHDA loan. A refinance is when you get a new mortgage on your home. Often homeowners do it to pull equity out of the home or get a lower interest rate.

Someone who lost their home during the Great Recession and has been renting since will also qualify. To be considered a first time home buyer by MSHDA, you can’t have owned a home in the previous three years. At the end of the day, it’s a great loan option for anyone. The MI Home Loan is the most common and has better terms. However, the Flex program does offer more flexibility for a home buyer.

This unique loan program allows you to finance a home with no down payment and little out-of-pocket expense. If you’re a first-time home buyer, getting enough money for a down payment can seem like a major hurdle. The Michigan State Housing Development Authority has a program that helps home buyers afford their down payment by loaning them up to $10,000 towards it This is what you need to know. The Michigan State Housing Development Authority offers several programs to assist Michigan residents in obtaining a home. The primary programs available are down payment assistance, lower interest rate with no down payment assistance, and Mortgage Credit Certificate.

A negative equity position is often referred to as being underwater on your mortgage. It’s when you owe more money than your home is currently worth. Instead, the $7,500 DPA and 10K DPA are the programs available to home buyers and they MUST be paid back. In my career, I have seen the joy of dozens of homeowners, who thought homeownership was never going to be possible for them, as they got the keys to a house. Tears often fill the eyes of these home buyers as they’re at the closing table. Here is a map published by the state with the qualifying 236 zip codes.

No comments:

Post a Comment